Sell Your Business Fast With Gulfstream

As a trusted industry expert for over 27 years, with hundreds of successful transactions, the Gulfstream Mergers & Acquisition team has harnessed the secret to business selling success- listening to our clients.

What makes Gulfstream Mergers and Acquisitions different is that we really partner with our clients to make sure that their ideal exit is achieved.

Know Your Value, Own Your Future

Complete the form below to receive your FREE valuation range.

For immediate assistance call: 1-704-892-5151

Value-Driven Solutions

You are not just a number. Your business is not “just another business.” Gulfstream Mergers and Acquisitions respects your time and will not take on an engagement we do not believe will close to satisfaction. Therefore, accept only a limited number of engagements.

Don’t worry. We will work with you through the selling process and focus on the maximum value.

Our 4-Step Process Tailored to Your Strategy

Step 1: Consultation and Evaluation

Step 2: Engagement and Market Preparation

Step 3: Confidentially Market the Opportunity

Step 4: Negotiate and Sale

Case Studies

Our Case Study Compendium Speaks For Itself

Since 1993, Gulfstream Mergers & Acquisitions is the firm hundreds of professionals have turned to represent them in the acquisition or selling of successful companies. Our dealmakers have managed over a billion dollars of deal flow across various countries and sectors while our principals are active in all phases of the process. Our success with transactions is what makes us uniquely effective in producing an effective transaction readiness process for you. We believe in producing results not just reports, while our perspective on exit planning is to make you a better target for our M&A process.

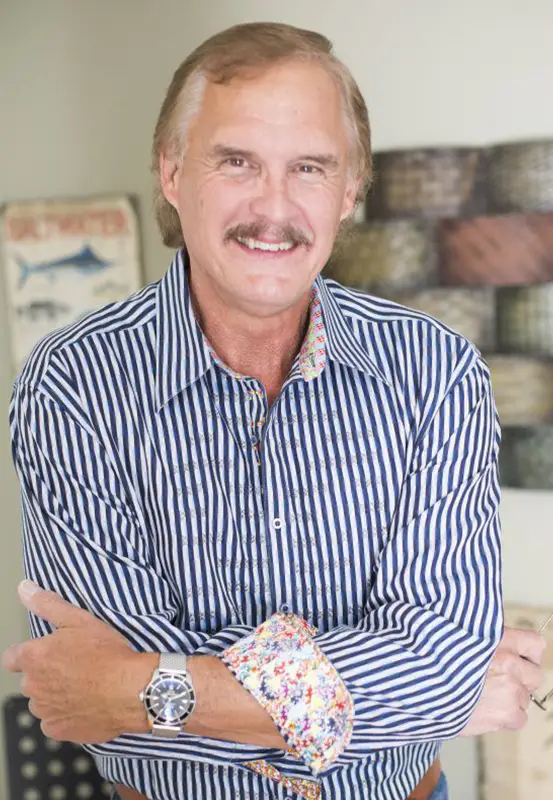

Meet Jim Kniffen

Founder and President of Gulfstream Mergers & Acquisitions

With over thirty years of successful entrepreneurial experience, Jim Kniffen has earned a stellar reputation for ethical excellence in the complex arena of mergers and acquisitions. Mr. Kniffen has extensive expertise in business and enterprise valuation, due diligence analysis, alternative sources of acquisition financing, and complex business consultation. Jim is also a sought-after public speaker by accounting and financial groups seeking his expertise in the complete M&A sales process; especially in the difficult areas of valuation and financing.

Jim Kniffen is a member of The Alliance of Merger and Acquisition Advisors, is a Charter Member of the Association of Professional Merger & Acquisition Advisors, and is a founding member of The Society for Leadership of Change (SLC). Jim received his graduate degree from Florida Atlantic University at Boca Raton in 1976.

M&A Continues as the Leading Growth Strategy Firm

The current M&A market remains a seller's market. Unsurprisingly, the global pandemic had a negative impact on overall deal volumes in 2020. Despite the challenges, the M&A marketplace proved to be incredibly resilient with near-record activity in the second half of the year. Deal Volume is expected to continue its rebound through 2022 and 2023.

The demand for quality acquisition targets remains largely insufficient. One of the chief challenges continues to be an overall shortage of quality companies on the divest side to feed the growing appetite of both U.S.-based and global buyers. We at Gulfstream encourage business owners to look at their transition goals and objectives and determine whether a company sale in this market makes sense for their circumstances.

2022 and 2023 appear to be earmarked for incredible rebound years within M&A, driven by several factors. We believe that industry and sector convergence will continue to be major themes, with a strong leaning toward vertical integration. Both talent and technology acquisition will remain strong drivers for acquirers as they continue to look for non-traditional methods to satisfy the need for talent and technology shortages.

Ready to talk? Give us a call at 1-704-892-5151 or fill out the form.